Gold Climbs to 3-Month High, Euro Leaders “Getting Benefit of Doubt”, Republicans Call for Fed Audit

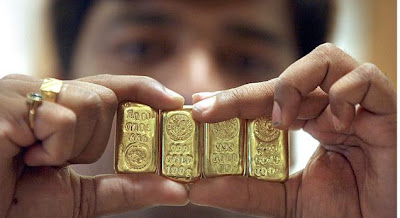

SPOT MARKET gold prices hit their highest level since early May Wednesday, rising to $1645 an ounce during this morning’s London trading.

Silver prices also gained, rising to $29.70 per ounce – their highest level since early June.

By contrast, European stock markets ticked lower, while commodities were broadly flat and US Treasuries gained, ahead of the publication of Federal Reserve policy meeting minutes later today.

A day earlier, gold prices jumped 1% in less than three hours Tuesday, hitting the top of the trading range that stretches back to May.

“The break above resistance from $1624 to $1629 is bullish,” say technical analysts at bullion bank Scotia Mocatta.

“This area should now provide some support.”

“There is a stimulus premium built into gold of $30-$40, we believe,” adds a note from ANZ.

“If the Fed minutes prove more hawkish than market expectations, some of that premium could evaporate.”

In India, which reclaimed its traditional position as the world’s biggest gold buyer in the second quarter, Rupee gold prices rose to near record highs Wednesday, with increased buying reported from retailers and investors.

On the currency markets this morning, the Euro rose to its highest level against the Dollar since July 5, following reports earlier in the week that suggested the European Central Bank will discuss a policy of intervention in bond markets when it meets next month.

“For the time being, it looks like investors are giving the Europeans the benefit of the doubt that they will indeed pull the proverbial rabbit out of the hat,” says INTL FCStone analyst Ed Meir.

Greece will need to find an extra €2 billion in austerity savings over the next two years, taking the total needed to €13.5 billion, if it is to meet its current bailout conditions, a senior Greek finance ministry official told newswire Reuters Tuesday.

Jean-Claude Juncker, head of the Eurogroup of single currency finance ministers, is visiting Athens today to hold talks with Greek prime minister Antonis Samaras. Samaras will then visit Berlin and Paris to meet German and French leaders later in the week.

“We are not asking for extra money,” Samaras says in an interview published in Wednesday’s addition of German tabloid Bild.

“All we want is a little ‘air to breathe’ to get the economy going and increase state income…more time does not automatically mean more money.”

In the US meantime, the Republican Party has said it will include language calling for an annual audit of the Federal Reserve as part of its Mitt Romney’s presidential campaign.

“Add this to Romney’s claim that he would not reappoint [Fed chairman] Bernanke after his current term expires in January 2014 and we can see that a Republican victory could give the market some reasons for concern,” says Steve Barrow, head of G10 research at Standard Bank.

Europe’s major clearing house LCH.Clearnet has said it will start accepting unallocated gold bullion as collateral to cover traders’ margins from next Tuesday. An initial haircut of 14% will be applied. The move follows a similar announcement by CME Clearing Europe last week.

The difference between gold prices and platinum prices continued to narrow this morning, after hitting an all-time high last week. Platinum rallied above $1520 per ounce Wednesday, following news that the world’s biggest producer, Anglo American Platinum, has received higher wage demands from its South African workers.

Source:http://www.livetradingnews.com/gold-price-at-3-month-high-83149.htm#.UDTbDqAkrbU